29+ Principal interest calculator

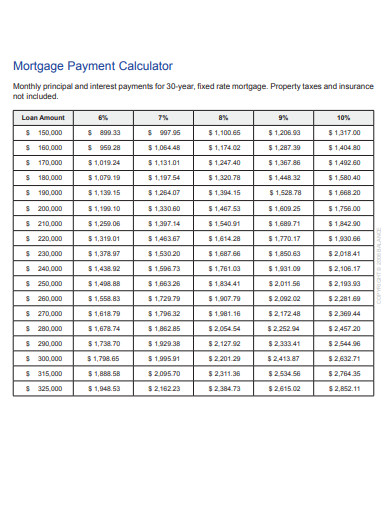

People typically move homes or refinance about every 5 to 7 years. Enter the loans original terms principal interest rate number of payments and monthly payment amount and well show how much of your current payment is applied to principal and interest.

Compound Interest Formula And Compound Interest Financial Quotes Learning Math

110 10 11.

. The APR which is the same as your interest rate will be between 790 - 2999 per year. See how those payments break down over your loan term with our amortization calculator. Now lets calculate your principal repayments.

The monthly interest rate payment calculator exactly as you see it above is 100 free for you to use. Interest Only Amortization Schedule. But unlike simple interest compound interest is added to the principal.

Explanation of the Interest Expense Formula. A daily compound interest calculator crypto can make it easy to figure out how much you will earn with compound interest. If you need help determining the end date or due date use the Prompt Payment Due Date and Interest Rate Calculator first.

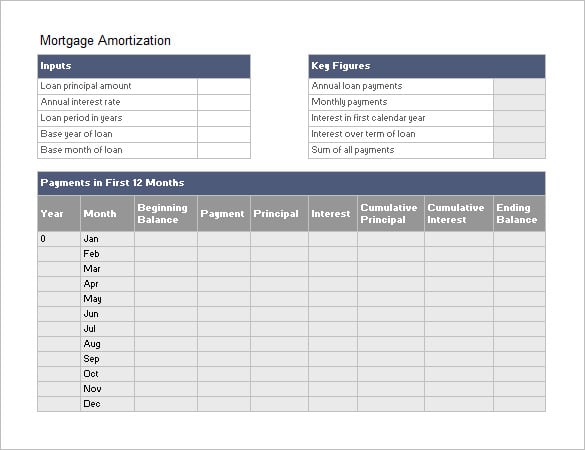

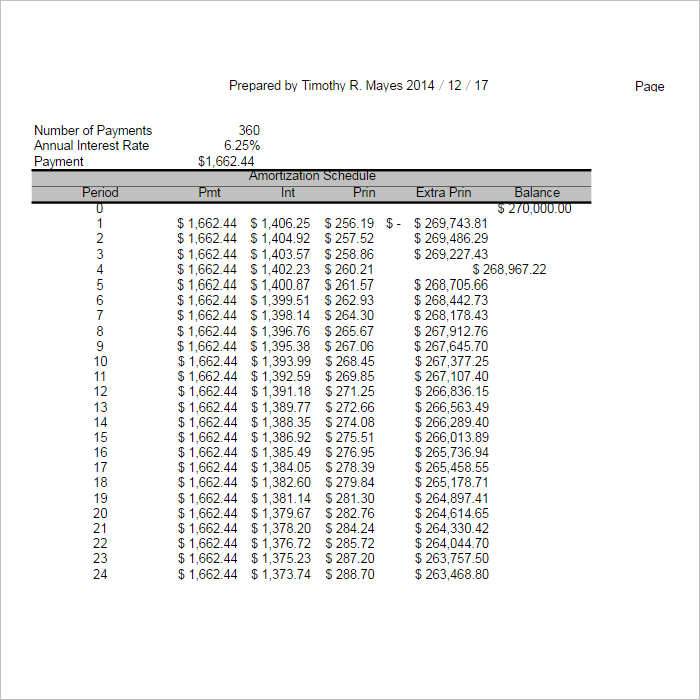

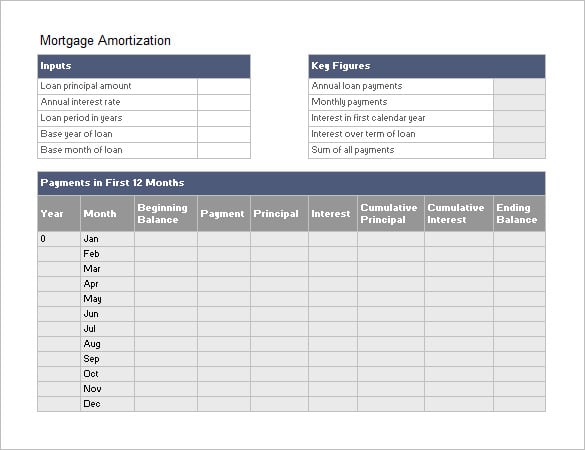

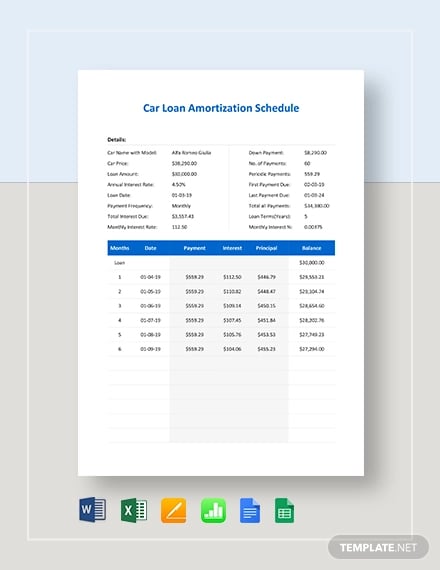

This means that with every mortgage payment you will be paying both your mortgage principal and your mortgage interest. For borrowers mortgage interest is charged based on your mortgage principal balance. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan.

August 29 2022 September 4. Free interest calculator to find the interest final balance and accumulation schedule using either a fixed starting principal andor periodic contributions. Like simple interest compound interest is charged on the principal.

Interest is computed on the current amount owed and thus will become progressively smaller as the principal decreases. Interest and amortized principal operate on different schedules so additional measures are required to keep payment amounts balanced over the life of a. 14229 3147463 15 136665 13639 3010798 16 137257 13047 2873541 17 137852.

In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Generally speaking this is a fixed interest land loan calculator.

The way fixed interest calculators work is that your payment remains level during the life of the loan. It is possible to see this in action on the amortization table. If a person stretches their loan payments out to 30-years they build limited equity in.

The interest charge for the second payment would be 16633 while 20329 will go toward the principal. Besides the EMIs the interest rate calculator also displays other relevant information including the total interest payable. Total cost of this personal loan would be Rs1500000 Rs431568 Rs1931568.

You can also use a spreadsheet to create amortization schedules. Future Value with Compound Interest Principal1Interest RateNumber of Times Compounded per YearYears to Calculate. Click the Customize button above to learn more.

Simple Interest Loan Amortization Calculator is an online personal finance assessment tool which allows loan borrower to find out the best loan in the finance market. The lender will require you to start paying principal and interest on an amortization schedule or pay off the loan in full. The mortgage amortization schedule shows how much in principal and interest is paid over time.

The mortgage interest charged is included in your regular mortgage payments. As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate. Interest expense is the cost at which the Lender gives money to the required party.

You see the summary of the above calculation using my Flat Rate Interest Calculator in the. This Daily Interest Loan Calculator will help you to quickly calculate either simple or compounding interest for a specified period of time. 500 166667 216667.

A part of the payment covers the interest due on the loan and the remainder of the payment goes toward reducing the principal amount owed. But you should still understand what this type of interest is. The APR will vary with the market based on the Prime Rate.

Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance. Use a home loan interest calculator after acquiring a housing credit. This calculator returns the dollar amount of interest on a late payment based on due date or end date later of servicegoods received or invoice date.

For example suppose you bought a house for 150000. So your total monthly payment will be. Build home equity much faster.

You can see this visually in the data table. When you change any input this calculator will automatically compute a loans payment amount based on the principal amount borrowed the length of the loan and the annual interest rate. With each passing monthly loan payment more of your payment goes toward principal and less money goes towards paying interest.

Interest Expense Principal Amount Total Borrowed Amount Rate of Interest Time Period. This calculator will help you to determine the principal and interest breakdown on any given payment number. This is your interest that you will pay in every installment.

While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. In the compound interest formula the principal is symbolized by a P just as in the simple interest formula. To see the full schedule or create your own table use a loan amortization calculator.

Principal Repayment Loan Amount Total Number of Installments. PrincipalUSD InterestUSD BalanceUSD 1 128637 21667 4871363 2 129195 21109. Dereks interest charge at the.

Interest Expense INR 10429 Cr. In this case the total interest would be Rs431568. Types of Amortizing Loans.

By the time of the last payment 30 years later the breakdown would be 369 for principal. Interest Expense is calculated using the formula given below. You can either calculate daily interest for a single loan period or create a loan schedule made up of multiple periods each with their own time-frames principal adjustments and interest rates.

Annual fees range from 0 - 300. The detailed explanation of the arguments can be found in the Excel FV function tutorial. Prompt Payment Interest Calculator.

To use this credit card interest calculator first gather your bank statements credit card account details and your credit report and score. For compounding interest rather than the original amount the principal any interest accumulated since is used.

9 Amortization Schedule Calculator Templates Free Excel Pdf

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Our Compound Interest Calculator Not Only Highlights The Value Of Personal Savings It Also Illustrates Interest Calculator Compound Interest Personal Savings

1

9 Excel Mortgage Loan Calculator Templates Free Pdf Formats

3

Simple Interest Si Calculator Formula Simple Interest Math Charts Formula

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

9 Excel Mortgage Loan Calculator Templates Free Pdf Formats

9 Excel Mortgage Loan Calculator Templates Free Pdf Formats

1

Loan Amortization Schedule In Excel Amortization Schedule Interest Calculator Excel Tutorials

Amortization Schedule Template 13 Free Word Excel Pdf Format Download Free Premium Templates

Compound Interest Ci Formulas Calculator Interest Calculator Compound Interest Compound Interest Math

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Amortization Schedule Template 8 Free Word Excel Documents Download Free Premium Templates

Mortgage Payment Chart